Published in the Nikkei Asian Review 6/8/2019

Japanese leaders have, in the past, often railed against public criticism of their policies by overseas economists. Never before, though, have they issued strongly worded rebuttals of foreign praise. Yet this is what happened when Professor Stephanie Kelton of Stony Brook University voiced her approval of government economic policy during her recent visit to Japan.

Professor Kelton is an advocate of Modern Monetary Theory, known as MMT, a heretical challenger to mainstream economics which maintains that the only constraint on public spending is inflation. In fact, the theory goes, there is no need for government spending to be financed by bond issuance at all. The central bank can simply create as much money as it likes until inflation becomes a problem.

Many supporters of MMT view Japan’s “Abenomics” as a case study that bolsters their argument. And that is exactly why the Japanese establishment has reacted as if being accused of membership in some wacky religious cult.

Finance Minister Taro Aso called MMT “an extreme and dangerous idea that weakens fiscal discipline” and Bank of Japan Governor Haruhiko Kuroda expressed “no sympathy whatsoever” with the theory.

The reaction amongst mainstream economists overseas has been similarly hostile. According to Larry Summers, MMT is “the voodoo economics of our time.” Kenneth Rogoff calls it a threat “to the entire global financial system.” Even Bill Gates dismissed it as “crazy talk.”

The nay-sayers’ main beef appears to be the risk of hyper-inflation as experienced by several Latin-American and African countries. MMT-ers riposte that such criticism caricatures their approach. Indeed, theoretically it could be compatible with inflation targeting as practiced in most developed countries today.

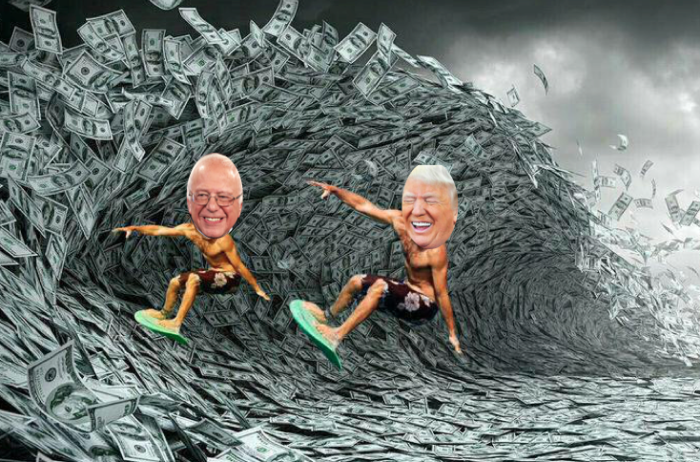

Professor Kelton is a former advisor to Bernie Sanders, the veteran left-winger once more seeking nomination as Democratic Party presidential candidate. A much younger radical American politician, Alexandria Ocasia-Cortez, has also shown strong interest in MMT. The theory has obvious attractions for the left because it seems to offer the prospect of limitless and costless public spending. In fact, though, it is closely linked to the “helicopter money” proposed by free-market enthusiast Milton Friedman as a cure for deflation.

Such money need not be spent by the government. It could be simply mailed to citizens to spend as they like.

Indeed, there is another potential recruit to the MMT cause on the other side of the American political spectrum. In “Fear: Trump in the White House”, author Bob Woodward recounts an argument between Trump and Gary Cohn, Treasury Secretary at the time. Trump suggests issuing a large amount of bonds to take advantage of historically low interest rates. Cohn slams the idea of breaching the politically-created “debt ceiling” as being harmful to US growth. Trump replies “Just run the presses – print money.” Woodward takes this as evidence of Trump’s ignorance. In fact, the president was probably referencing the latest economic theory.

In many fields of intellectual enquiry, what was once heresy is now orthodoxy. Economics is no exception. The last time a paradigm shift occurred in macro-economic policy was in the 1970s, when monetarism, which placed emphasis on control of the quantity of money, displaced the post-war Keynesian consensus, which viewed fiscal policy as the key determinant of demand.

At the time, monetarism was a controversial fringe movement with little support amongst mainstream academics and policy-makers, but it seemed to offer a solution to a serious real world problem that the Keynesians had not anticipated and could not explain – the co-existence of high inflation and high unemployment.

A similarly puzzling phenomenon is visible in today’s world – this time the co-existence of low unemployment and low or no inflation (and likewise wage growth) in many developed countries. As in the 1970s, the Phillips curve, which purports to establish a reliable relationship between employment and inflation, has gone missing. And just as the monetarists brought in a radical new approach, now we have the MMT-ers advocating unfunded fiscal expansion.

Does the Japanese experience validate MMT, as Professor Kelton implied? Perhaps. It certainly raises serious doubts about the “fiscal discipline,” strongly advocated by Kenneth Rogoff, Christine Lagarde and many other experts and policy-makers since the global financial crisis of 2008. For Japan has been running large fiscal deficits for the past twenty years and has consequently amassed a Mount Fuji-sized pile of outstanding government debt, equivalent to 230% of Japanese GDP. Far from triggering a bond market rebellion and soaring interest rates, as doomsters consistently predicted, Japanese interest rates have fallen to vanishing point.

Since the start of Abenomics in 2013, the story gets even more interesting. Thanks to the quantitative easing programme of bond purchases introduced by Bank of Japan Governor Kuroda, some 40% of all outstanding Japanese government bonds now sit on the BoJ balance sheet. In other words, one arm of government owes a vast sum of money to another arm of government – which means that no debtor-creditor relationship exists. Despite the strident disclaimers of the Japanese authorities, this is not far removed from the world of MMT.

Having said that, the major cause of Japan’s public deficits was not fiscal expansion, but the collapse in tax revenues that happened during the two “lost decades.” In the first year of Abenomics, the government did increase public spending and the economy rebounded and inflationary expectations soared accordingly. Since then, however, fiscal policy was tightened. With one unnecessary and counter-productive tax hike being followed by another this autumn, it is no surprise that inflationary expectations have collapsed.

Before the global financial crisis, Japan’s rock bottom interest rates appeared to be a bizarre and unique phenomenon. No longer. Now there are over twelve trillion dollars of negative yielding bonds in the world, including some corporate bonds. In many countries the stimulatory effect of lower interest rates has already passed the point of exhaustion, raising the question of what governments will do to counter the next recession.

What the markets are asking them to do is clear – take advantage of these unprecedentedly low interest rates to issue boatloads of bonds and pump money into their economies. The Austrian government has just launched a tranche of its 100 year bond at an interest rate of 1.2%. Judging by the comparative yields of their 30 year bonds, Japan could probably borrow one hundred year money for less than 1%.

Instead of raising taxes on consumption and damaging growth, it could be investing in infrastructure, clean energy and fertility incentives that would increase the expected population and revive sadly depopulated regions.

Not every country is in the same position as Japan, which is the world’s largest creditor nation and has been clocking up current account surpluses since the early 1980s. But it is fairly clear that in many countries a combination of monetary easing and fiscal expansion, as well as tax reform (not hikes), is required to revive growth. If mainstream politicians and technocrats do not rise to the challenge, then the populists will fill the gap.

That could be dangerous because MMT has so far little to say about the varying financial conditions of different countries and the magnitudes of stimulus that are required for the remedy to work. It is all too easy to imagine countries that are, unlike Japan, already under-saving and over- consuming going too far – and ending up with out-of-control inflation.